Learn about certified payroll, what it is, how it works, and how to fill in a WH-347 form. Includes H-347 form download.

Updated on May 29th, 2023

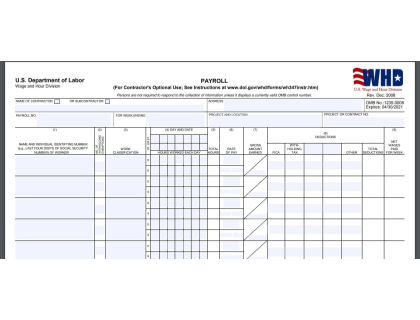

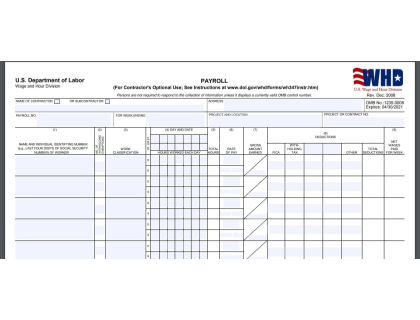

Certified Payroll is a federal WH-347 payroll form that is submitted weekly by employers working on federally funded projects. A WH-347 form should be completed for every contracted work week and provided to the firm overseeing your contract.

The form lists personal details about every worker on the project, hours worked, wages, and benefits. The form also includes a compliance certificate.

Download Form WH-347 as a fillable PDF.

Download Now Instant download. No email required.To comply with the Department of Labor (DOL) requirements, employers must submit a signed WH-347 certified payroll report for every week the company performs contract work in addition to the standard business payroll forms.

If your company is a subcontractor, you should submit your report to the main contractor. If your company is the main contractor, you should submit the certified payroll report to the federal agency contracting the project.

Compare different payroll software options, including leading competitors Gusto, TriNet Zenefits, and QuickBooks Payroll. See reviews, pricing info, and FAQs.

Payroll that is certified for the prevailing wage is payroll that has been submitted with a federal form to certify that wages paid meet the standard set by the Government as outlined in the Davis-Bacon act.

When the head of payroll or the company owner puts their signature on the certified payroll statement of compliance, they do so with the understanding that any willful falsification of payroll information may be subject to prosecution.

Fill in your company name and check the appropriate box.

Fill in your company's address.

List the appropriate payroll number. If this is your first time submitting certified payroll, start with 1.

Enter the end date of the current workweek.

Identify the project and enter the city and state where the project is located.

Enter the appropriate contract number.

Enter the full name of each worker and their identifying number. You can use the last four digits of their social security number.

This column is optional. If you want to fill it out, it will reflect on the workers' W-4 form.

List the classification descriptive of the work performed by laborers or mechanics.

Enter the day and date for hours worked. Fill in the appropriate boxes for straight time and overtime.

Add up the straight time and overtime hours worked and enter the total.

Enter the hourly rate paid for straight time work plus cash paid in lieu of fringe benefits.

Enter the gross earnings for the project.

List deductions in the five boxes provided.

Subtract deductions from gross earnings and enter the amount.

Creating certified payroll reports is made easier when you use payroll software. Many payroll software systems, including RUN Powered by ADP and QuickBooks, can automate the certified payroll process and eliminate double entries and miscalculations on hours worked, job codes, and pay rates.

Discover the best free payroll software with features and reviews. Includes comparisons between top picks Gusto, TriNet Zenefits, and QuickBooks Payroll.

Certified payroll is a federal WH-347 form that must be submitted weekly to the agency overseeing a federal government contract.

If you are an employer working on a federal contract, you are required to submit a signed WH-347 certified payroll report for every contracted work week. The form list details about every worker on the project including the number of hours worked and wages earned.

You can download Form WH-347 from the U.S. Department of Labor website.

A certified payroll report must be submitted by any contractor or subcontractor working on a project that is fully or partially funded by federal money, provided the contract exceeds the amount of $2,000.

The Davis Bacon act is a United States federal law establishing the requirement for prevailing wages on public works projects. The act applies to contractors and subcontractors working on federally funded contracts exceeding the amount of $2,000.

Yes, all certified payroll employees must be paid weekly.

Yes, from the QuickBooks report menu, choose "Employees & Payroll," then "More Payroll Reports in Excel," then "Certified Payroll Report."

No, but it does need to be signed by the payroll manager or the company owner.

According to payscale.com, the average Certified Payroll Professional in the United States makes $68,000 per year.

Certified payroll and prevailing wage are two different things, but they are related. The prevailing wage is the fair wage specified for federal contractors in the Davis-Bacon act. Certified payroll is payroll submitted with a federal form to certify that the appropriate prevailing wages have been paid.

© 2024 The SMB Guide Inc, 20 W Kinzie St Chicago IL 60610